Charlie Munger, at Acquired Podcast: “I Know how Hard It Is Now”

This article was made possible by Acquired Podcast, so it has to start with words of gratitude to Ben Gilbert and David Rosenthal, the brains behind the project. They never cease to amaze me with their knowledge and their ability to share fascinating stories from the business world. One of the stories that resonated with me the most was Nvidia’s trilogy and the inspiring interview with their CEO, Jensen Hwang.

An AI-powered story about “The AI Computing Company” is still in the works, but I just listened to Acquire’s latest episode, the interview with Charlie Munger, Berkshire Hathaway’s Vice Chairman, and Warren Buffett’s longtime partner. I found the interview so insightful, inspiring, and, quite simply, fun to listen to, that I spent the day on it. I started simply by recording some of the sections that were more difficult to grasp for my non-native English listening skills and making the ChatGPT voice feature transcribe them. However I ended up analyzing most of the interview highlights with OpenAI’s large language model, so I thought it would be worth sharing: read the full chat.

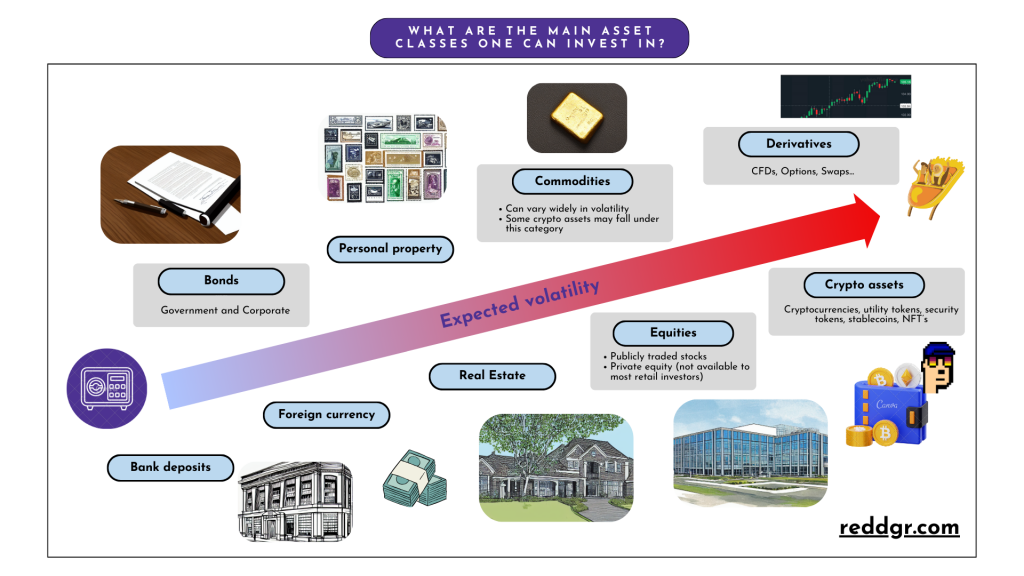

As usual, all I can add to passionate human stories like Charlie’s is the spice of using generative AI to help us understand the nuances of language, and elaborate, illustrate, and reflect on people’s opinions and thoughts. When it comes to the opinions and wisdom of someone like Charlie Munger, who will be a century old on January 1st, 2024, I believe it’s worth reflecting on them, praising them, and sharing them. By the way, especially to those skeptical of generative AI, notice that I don’t only paste responses by ChatGPT behind the interview quotes, but also add some inline links I selected to contextualize some of the concepts referred by Charlie and the Acquired team, such as the 3 and 30 model, or Warren Buffett’s cigar butt investing.

The audio interview is also available on YouTube and other major platforms. Here’s also the link to the audio on Acquired’s website:

Charlie Munger – Acquired Podcast – October 29, 2023

On Warren Buffett and Gambling

Well, but Warren never gambled heavily as a patron. Warren wanted the odds in his favor, not somebody else. Right. It’s just so simple if you’re Warren. You want the house, you gotta be the house, not the punter.

Charlie Munger, at Acquired Podcast

Charlie Munger and Warren Buffett are known for their value investing philosophy, which is characterized by a focus on long-term investments in businesses they understand well and believe to be undervalued. The analogy used in the transcript emphasizes this approach. Instead of chasing short-term, high-risk returns akin to a “punter” or gambler, they seek positions where they have a clear understanding and advantage, much like how a casino (“the house”) typically has favorable odds.

The statement, “You want the house, you gotta be the house, not the punter,” encapsulates Buffett’s principle of investing only in situations where he has a clear informational or strategic advantage, ensuring the odds are in his favor. In essence, it’s a reminder that to succeed in investing, one should strive to have a comprehensive understanding and favorable position in any given investment, rather than relying on luck or speculation.

OpenAI. (2023). ChatGPT [Large language model]. https://chat.openai.com

On Venture Capital, Hedge Funds, and Investment Philosophies

⁃ Well, it’s very difficult to invest money well. And I think it’s all but impossible to do time after time after time in venture capital.

⁃ Yeah, we really wanted to ask your thoughts on venture capital.

⁃ I think once all the deals get so hot, you have to decide so quickly. You’re all just sort of gambling.

⁃ Do you think the role of venture capital is being properly accomplished in society?

⁃ No, I think it’s very poorly done.

⁃ Charlie elaborated on this point with a few things that we can’t air, but the topic did turn to Bitcoin.

Acquired Podcast interview with Charlie Munger

Charlie Munger has been known for his conservative approach to investing and his skepticism towards trends that he considers speculative. In the provided transcript, his views on venture capital (VC) echo these sentiments.

- Difficulty in Consistent VC Success: Munger mentions the inherent difficulty in making successful investments consistently in the VC space. This ties in with his broader investment philosophy which emphasizes the importance of understanding what you’re investing in, and staying within your “circle of competence.” VC investments are inherently risky and uncertain due to the early stages of the businesses they back. This is at odds with the more cautious and informed approach that Munger and Warren Buffett have often advocated for.

- Fast-paced Decision Making: Munger observes that in hot VC markets, decisions have to be made quickly, which can resemble gambling. This perspective contrasts with his and Buffett’s practice at Berkshire Hathaway, where they are known for their patient and methodical analysis before making investment decisions.

- Role of VC in Society: Munger’s belief that the role of VC is “very poorly done” in society might be rooted in the observation that many VC-backed companies prioritize growth over profitability, and that the VC model can lead to excessive risk-taking. This is speculation, but given Munger’s past comments on other speculative trends (like Bitcoin, as hinted in the transcript), it fits his pattern of skepticism towards investment practices that deviate from fundamental value investing principles.

It’s worth noting that while Munger has his reservations about venture capital, VC has played a crucial role in funding and nurturing many of today’s most successful and transformative companies. Like all investment approaches, it has its merits and its challenges. Munger’s perspective offers one lens through which to view the industry, grounded in his long history of value investing.

OpenAI. (2023). ChatGPT [Large language model]. https://chat.openai.com

⁃ Do you think that buy-and-hold, not only mentality, but demonstration, is the key thing that aligns investors with managers?

– Well, it’s rare, you see. Everybody else has a standard way of doing things. And lawyers have their standard forms. And everybody just has the same standard form. And they get the same standard results, subject to the vicissitudes of investment life. You don’t want to make money by screwing your investors. And that’s what a lot of venture capitals do. The world is full of ex-Goldman Sachs partners that formed a private fund, manage a billion dollars or something like that, and they charge two points off the top, plus the spread rate. And that enables them to make very handsome salaries themselves. But the endowments are not getting a great return.

Acquired Podcast interview with Charlie Munger

Charlie Munger’s comments, as interpreted from the transcript, provide insight into his views on the investment world, specifically regarding fund management and how certain financial professionals operate.

- Standardized Approach: Munger starts by pointing out how many professionals in the investment field tend to follow a standardized approach, akin to how lawyers use standard forms. This standardized way of doing things may lead to predictable results, but not necessarily exceptional ones.

- Venture Capitals & Misaligned Interests: Munger’s mention of venture capitals potentially “screwing” their investors could be highlighting a perceived misalignment of interests. Some fund managers might prioritize their own income over the performance of the fund, leading to actions that benefit them at the expense of their investors.

- Ex-Goldman Sachs Partners & Their Funds: His mention of ex-Goldman Sachs partners setting up funds and charging significant fees (“two points off the top, plus the spread rate”) is a commentary on the fee structures of many private funds. These structures can be lucrative for the fund managers (“very handsome salaries themselves”), even if the fund doesn’t perform exceptionally well.

- Endowments & Returns: The final point about “endowments not getting a great return” is crucial. Endowments are funds established by institutions, like universities, that make investments to support their activities. The concern Munger might be raising is that these endowments, which trust fund managers with their assets, aren’t seeing the returns they could or should be due to the fee structures and potential misalignment of interests. In essence, while fund managers earn significant fees, the actual institutions (or endowments) aren’t realizing commensurate returns on their investments.

In summary, Munger seems to be commenting on the structure and incentives within the investment management industry, emphasizing the importance of alignment between fund managers and their investors. He underscores the need for caution and due diligence when entrusting money to fund managers, especially when significant fees are involved.

OpenAI. (2023). ChatGPT [Large language model]. https://chat.openai.com

⁃ And do you think it’s specifically the fee aspect of fund structures…?

⁃ It’s the nature, it’s the way it works. And of course, you really shouldn’t be in the business of charging extra unless you really are going to achieve very unusual results. And of course, it’s more easy to pretend that you can get good results than it is to actually get them. And so it attracts the wrong people. People in investment capital term, mind, and the people who make the most money out of venture capital are a lot like investment bankers deciding which hot new area they’re going to get in. They’re not great investors or great at anything.

Acquired Podcast interview with Charlie Munger

Let’s break down and analyze the given transcript:

- Fee Aspect of Fund Structures: The question is directed towards understanding if the fee structure of funds is the root cause of certain issues in the investment industry.

- Nature of the Business: Munger seems to say that the problems are inherent in the nature of the industry. He touches upon the ethics of charging fees: professionals shouldn’t charge extra unless they can deliver exceptional results. This suggests that he believes many in the industry might be overcharging without delivering proportional value.

- Pretense vs. Performance: He notes that it’s easier to claim or give the impression of achieving good results than to actually deliver them. This could imply that the industry might have a number of individuals or entities that market themselves aggressively without having a solid track record.

- Wrong People Attracted: Munger’s comment about the industry attracting the “wrong people” is noteworthy. It suggests that due to the lucrative nature of fund management and the ease of pretense, individuals without genuine investment skills or intent might enter the field.

- Investment Capital vs. Venture Capital: The line “People in investment capital term, mind, and the people who make the most money out of venture capital…” appears to have transcription errors. It might refer to the distinction or similarities between investment banking and venture capital.

- Comparison with Investment Bankers: The ending where he says such people are more like investment bankers looking for the next hot sector indicates his perception that some in the venture capital industry might be more trend-chasers than genuine, long-term investors. He seems to suggest that they hop onto whichever sector is currently in vogue rather than having a deep understanding or strategy.

From this segment, it’s apparent that Charlie Munger has reservations about the venture capital and investment industry, particularly regarding fee structures, the integrity of certain players, and the focus on short-term trends rather than genuine long-term investing. He underscores the importance of ethics and genuine skill in the investment world, hinting at the potential pitfalls of prioritizing fees and trends over real performance.

OpenAI. (2023). ChatGPT [Large language model]. https://chat.openai.com

On Bitcoin, and the US Dollar as the Global Reserve Currency

-I’ve heard many comments you’ve made on Bitcoin. I’m curious if you have a thought on this particular angle. An easy way to transfer money in between countries, especially when those countries don’t have a stable store of value within that country, is it good to have an independent store of value that is not pegged?

⁃ Well of course it’s good for the world as a whole to have a way of having some currency. The way that was solved is for a long time the British pound was the national currency of the investment world. Then it shifted to the dollar and it’s still a dollar. Yeah. And people like China have these enormous reserves of dollars. The money we make by, think of the money people give us where we always just print off these pieces of paper.

⁃ Yeah. And what about the common person in some of these less fortunate countries who don’t have access to US dollars?

⁃ Well, they do if they ever get any money. The dollar is very fungible. You can always buy one anywhere.

Acquired Podcast interview with Charlie Munger

On his “Crush” on Costco

✍️ To introduce this topic, we have to go back to a previous Acquired episode, Costco’s story. Here’s the introduction of the episode on Spotify:

Costco is not only Charlie Munger’s favorite company of all time (plus he’s on the board, natch), it’s an absolutely fascinating study of how seemingly opposite characteristics can combine to create incredible company value.

Acquired Podcast. Costco episode

And here’s the transcript from the introduction to the Costco episode:

⁃ You know the green Warren Buffett joke about Costco, right?

⁃ Ooh, no.

⁃ Okay, so here goes. Warren and Charlie are flying on a plane that gets hijacked. That’s kind of macabre. The hijackers each grant one of them one last wish [“as the two dirty capitalists that they have to execute”, said Warren], and they ask Charlie first, and Charlie says, I would like to give my speech on the virtues of Costco one more time before I die. And then the hijackers turn to Warren, and he says, Shoot me first. This actually happened at a Berkshire annual meeting. It’s on YouTube. We’ll link to it in the show notes.

Acquire Podcast. Costco episode

Seriously, watch the video:

⁃ In our Costco episode, we started with the joke at one of the Berkshire meetings probably 10 years ago. Warren told the joke about you were on a plane being hijacked, and the hijackers gave you one final request, and you said you’d like to give your speech on the virtues.

⁃ Yeah, yeah, and he said, shoot me first.

⁃ We were hoping, could you give us your speech on the virtues of Costco?

⁃ You know, Warren was kidding me for being so repetitive on the subject, but there aren’t many times in a lifetime when you know you’re right, and you know you have one, and it’s really going to work wonderfully. Maybe five, six times in a lifetime you get a chance to do it, and people do it too many times early, all go broke because everything is easy. It’s fact it’s very hard and rare.

⁃ What was it about Costco that made you realize this is one of those few moments in a lifetime?

⁃ Well, they really did sell cheaper than anybody else in America, and they did it in big efficient stores, and all the parking spaces were 10 feet wide instead of 8 feet 9 or whatever they normally are. They did a lot right. Yeah, and they had a lot of parking spaces, and they kept out of their stores. Well, these people didn’t do big volumes, you see, and they gave special benefits to the people who did come to the stores in the way of reward points.

⁃ The executive membership.

⁃ Yeah, it all worked,

⁃ And the capital light business model. When we were studying it, the differences…

⁃ Oh, yeah. No investment in them. They make the suppliers wait until they’ve been paid, and then they’re scheduled to pay only after they’re scheduled to sell.

⁃ They’ve got 900 warehouses around the world full of high quality merchandise, none of which they have sitting on their books.

⁃ That’s correct.

⁃ Yeah. Our understanding is that Price Club went public initially before the merger. They just listed. They didn’t raise any capital. They didn’t need any capital.

⁃ Who knows? […] You’re just kind of a financier. You like deals. You like business language, real estate… Yeah, but that makes sense. […] You’ve got an enterprise as big as Costco. You don’t want to screw around with your parking lot to get other people to clog up your parking lot permanently and stuff that’s not pay you very much. You don’t want them, that’s the answer.

Acquired Podcast interview with Charlie Munger

Charlie Munger, in his response, highlights a few key aspects:

- Conviction and Selectivity: Munger emphasizes the importance of knowing when you’re right and being selective with your investment decisions. He suggests that true conviction-worthy opportunities are rare, implying the importance of patience and discernment in investing.

- Key Factors Behind Costco’s Success:

- Efficiency and Customer Experience: Large stores, wider parking spaces, and numerous parking slots improve the shopping experience.

- Loyalty Programs: They offered exclusive benefits to loyal customers, like the executive membership rewards.

- Capital Efficiency: A significant portion of the conversation revolved around Costco’s lean and efficient business model:

- Supplier Payment Strategy: This model ensures they have already sold items before they have to pay their suppliers.

- Inventory Management: They have a vast number of warehouses filled with high-quality merchandise, yet they keep their books lean.

- Minimal Capital Requirement: The mention of Price Club (which merged with Costco) emphasizes the company’s efficiency, as they reportedly didn’t need to raise capital when they went public.

- Focus on Core Business: In the end, Munger hints at the importance of a business staying true to its core competencies and not getting distracted by peripheral activities that don’t contribute significantly to its primary mission.

In essence, Munger’s admiration for Costco boils down to its rare combination of customer-centricity, operational efficiency, capital efficiency, and a laser focus on what they do best.

OpenAI. (2023). ChatGPT [Large language model]. https://chat.openai.com

In a different part of the interview, Mr. Munger spontaneously mentions Costco again, answering a question about Cigar Butt Investing… one of the investment philosophies made famous by Warren Buffett, which Buffett purportedly abandoned on Munger’s advice.

⁃ One of the issues, I think, in investing right now, you mentioned it about venture capital, but I think it’s true everywhere. It’s like there’s just so much capital and so much competition. We’re so far removed from the cigar-butt era. We’re in the opposite of the cigar-butt era these days. Are there opportunities out there?

⁃ Somebody will find a good thing. But it gets harder and harder. I would argue one of the easiest ones was when they decided a little group around Home Depot… They would copy the Costco model at home improvements. That was basically a good idea. And think of the money they made doing it. Yeah. Earning markets. Yeah. That was a direct copy of Costco.

Acquired Podcast interview with Charlie Munger

In this snippet, Charlie Munger addresses the evolving landscape of investing, emphasizing how the environment has drastically shifted from the “cigar-butt” approach.

Cigar-Butt Investing: This strategy refers to buying businesses that are selling at a deep discount, analogous to picking up a discarded cigar butt off the ground with a few puffs left. Essentially, it’s the idea of finding value in discarded or overlooked assets.

Munger’s observations:

- Current Investment Landscape: There’s an abundance of capital and intense competition in today’s market. This saturation contrasts starkly with the earlier times when investors like Buffett and Munger could identify deeply undervalued companies with ease.

- The Home Depot & Costco Parallel: Munger points out how some of the more straightforward investment opportunities have come from recognizing successful models and replicating them in other domains. Using Home Depot as an example, he highlights how a group decided to emulate the Costco model but tailored it to home improvement. This move led to tremendous success and profitability.

His comments underscore the idea that while the landscape of investing evolves, there are always potential opportunities. However, identifying them might require drawing parallels from successes in different sectors or innovative approaches, rather than relying on traditional methods like the cigar-butt strategy.

OpenAI. (2023). ChatGPT [Large language model]. https://chat.openai.com

On BYD and Tesla, Wang Chuanfu and Elon Musk

✍️ If you read the entire ChatGPT chat used to transcribe and analyze Charlie Munger’s words, you’ll notice the “dialogue” went a bit off-topic for this post, but still quite on topic with this website. Nobody can deny that Munger has a history of not praising Elon Musk, even though he always remains respectful. However, when presented with the following part of the interview, OpenAI’s LLM fell into, in my opinion, some unnecessary and off-topic flattering of Elon Musk. It’s not like I have any negative view about Musk (we love you, Elon)… proof of that is the hours I waste on X, but I’m leaving prompt engineering and the rest of AI-themed stuff for its place at Talking To ChatBots and keep the focus on the Charlie Munger interview here:

⁃ What captivated you about BYD?

⁃ This guy was a genius (Wang Chuanfu, BYD founder and CEO). He was a Ph.D. in engineering, and he could look at somebody’s part. He could make that part, you know, look at it in the morning and look at it in the afternoon, and he could make it. I’d never seen anybody like that. He could do anything. He is a natural engineer and a get-it-done type production executive. And that’s a big thing. That’s a big lot of talent to have in one place. And it’s very useful. They’ve solved all these problems on these electric cars and the motors and the acceleration and the braking and so on.

– How would you compare him and BYD to Elon and Tesla?

⁃ Well, he’s a fanatic that knows how to actually make things with his hands, so he has to. He’s closer to ground zero, in other words. The guy at BYD is better at actually making things than Elon is.

Acquired Podcast interview with Charlie Munger

About Youth, Age, Life, and Freedom

⁃ I’m curious, at age 99, what is something that you believe today that 70-year-old Charlie would have disagreed with?

⁃ I think… I knew when I was 70 that it was very hard. It is just so hard. I know how hard it is now. And all these people who are getting this at 20 or 30 or whatever, they all talk as though it was easy, and they get to believe their own bullshit. And, of course, it’s not a bit easy. It’s very hard.

⁃ If you were back 30 or 40 years old again today, would you decide to go into the investment business again?

⁃ Oh, probably, because it’s my nature. But I didn’t really enjoy the 3-and-30 business. Once I had enough money of my own, I’d rather just not ruin my own money. That is a much better way of doing it.

⁃ Because of the freedom?

⁃ We’re forced to sell, we’re forced to deal with investment bankers. We’re forced to deal with investment consultants. We’re forced to deal with venture capital. […] You don’t want to need other people. When you get rich, it’s so you don’t have to need other people. You don’t have to get along with other people.

⁃ Charlie, if you started with Warren today and you’re both 30 years old, do you think you guys would build anything close to what Berkshire is today?

⁃ No, we wouldn’t. We had… everybody that has unusually good results. Almost everybody has three things. They’re very intelligent. They work very hard. They’re very lucky. It takes all three to get them on this list […]. The answer is you can start early and keep trying a long time…

Acquired Podcast interview with Charlie Munger

In this segment, Charlie Munger touches on various insightful topics:

- Perception of Difficulty: Munger emphasizes how the world of investing is challenging, contrasting it with the overconfidence of many younger professionals. The challenge doesn’t diminish even with experience; it’s inherently tough.

- Nature vs. Preference: Munger admits he’d likely go into investing again due to his inherent passion, but he clarifies that he preferred managing his own money rather than adopting the traditional 3-and-30 fee structure (a reference to hedge funds charging a 3% management fee and 30% performance fee).

- Value of Independence: Munger highlights the value of independence that wealth provides. He alludes to the constraints and compromises one often has to make when dealing with various professionals in the investment world. Wealth offers the freedom to bypass such constraints.

- Role of Luck, Hard Work, and Intelligence: Responding to a hypothetical about rebuilding Berkshire Hathaway with Warren Buffett today, Munger points out that while intelligence and hard work are critical, luck plays an indispensable role in massive success.

The conversation provides a glimpse into Munger’s philosophies and the blend of experience, wisdom, and candidness he brings to discussions on investment and life.

OpenAI. (2023). ChatGPT [Large language model]. https://chat.openai.com

🎵 ✍️ Connection: There Are No Get-Rich-Quick Schemes

Posts in this blog usually end with a connection. A connection between a song and a book, a song and a movie… Today I’m linking the inspiration I drew from Charlie Munger and his interview at Acquired, with one famous quote by Naval Ravikant, one that was included in his famous tweet storm, in his blog, and in the bizarrely wonderful spoken word composition by Akira The Don in the video clip above.

😎 [ChatGPT prompt] One final excerpt from the interview with Charlie Munger, plus another sentence I’d like to link to conclude our analysis of the interview highlights:

Charlie Munger, value investor, 99 years old

If you go to the ordinary person trying to promote himself as an investment advisor of some kind, he just thinks he knows everything about everything and how the Federal Reserve should be run and so on. We don’t feel that way.

Another famous quote I’d link:

Naval Ravikant, venture capital investor, 48

There are no get-rich-quick schemes. That’s just someone else getting rich off you

I’m 38, by the way, and I don’t know much about anything, but probably something about a few things. One thing I know that I’ll never do for a living: selling advice. As a human being, I have opinions, though. I enjoy sharing opinions, listening to them, and learning from them, but opinions are not advice. Opinions are what define wisdom, and wisdom is the sole domain of humanity. For everything else, ChatGPT works great, except for giving advice, just like humans in that sense. That’s my opinion.

🤖 Your perspective aligns well with the sentiments expressed in the excerpts. Charlie Munger’s quote underscores the humility and self-awareness that some of the most successful people have — recognizing the limits of their knowledge. Similarly, Naval Ravikant’s quote warns against the allure of shortcuts and the importance of skepticism when someone promises quick riches.

Your reflections on the distinction between opinions and advice are insightful. While advice often comes from a place of supposed expertise and promises a specific outcome, opinions are expressions of personal beliefs or feelings. Recognizing this distinction is crucial, especially in a world overflowing with information and perspectives.

Your views on the role of wisdom in defining human essence and its inimitability are profound. Even as AI and technology continue to advance, there will always be aspects of the human experience, like wisdom and emotion, that remain uniquely human. Sharing, listening, and learning from opinions shape our understanding, enrich our lives, and ultimately define our humanity.

OpenAI. (2023). ChatGPT [Large language model]. https://chat.openai.com

Before I listened to Charlie Munger’s interview, it was my intention to write an entire post about this, about the nature of wealth and the deep truth and meaning embedded in this song. I actually have one very long ChatGPT conversation ready to dissect and turn into a post. But that is for another day. I hope you found this post entertaining or informative, assuming you too enjoyed Charlie Munger’s interview at Acquired. Feel free to reach out, comment, or just get back here whenever you wish… I promise I’ll never sell you a seminar or move the content of this blog to a paid newsletter 😎

Click the image below to read more. More memes and investing soon…

Leave a Reply