Buy When There’s Blood in the Streets: Contrarian Investing

Themes: Business and Economics, Finance and Wealth.

Prompt engineering use cases: Investing Research, Web Research

[Original X.com post] [Bing Chat]

😎 I used the famous quote “buy when there is blood in the streets” on October 15th 2011, implying it would be a good moment to buy. However, I posted this on a social network where a lot of old content is deleted for various reasons. Can you guess which important events might have been going on during that period that led me to use that sentence?

Buy When There's (literally) Blood In The Streets http://t.co/HvxlamEq

— David G. R. 😎 (@dgromero) October 15, 2011

🤖 That’s an interesting question. I can see why you used that quote, as there were many events happening around the world in October 2011 that could have caused fear and uncertainty in the markets. Some of the possible events that might have influenced your decision to buy are:

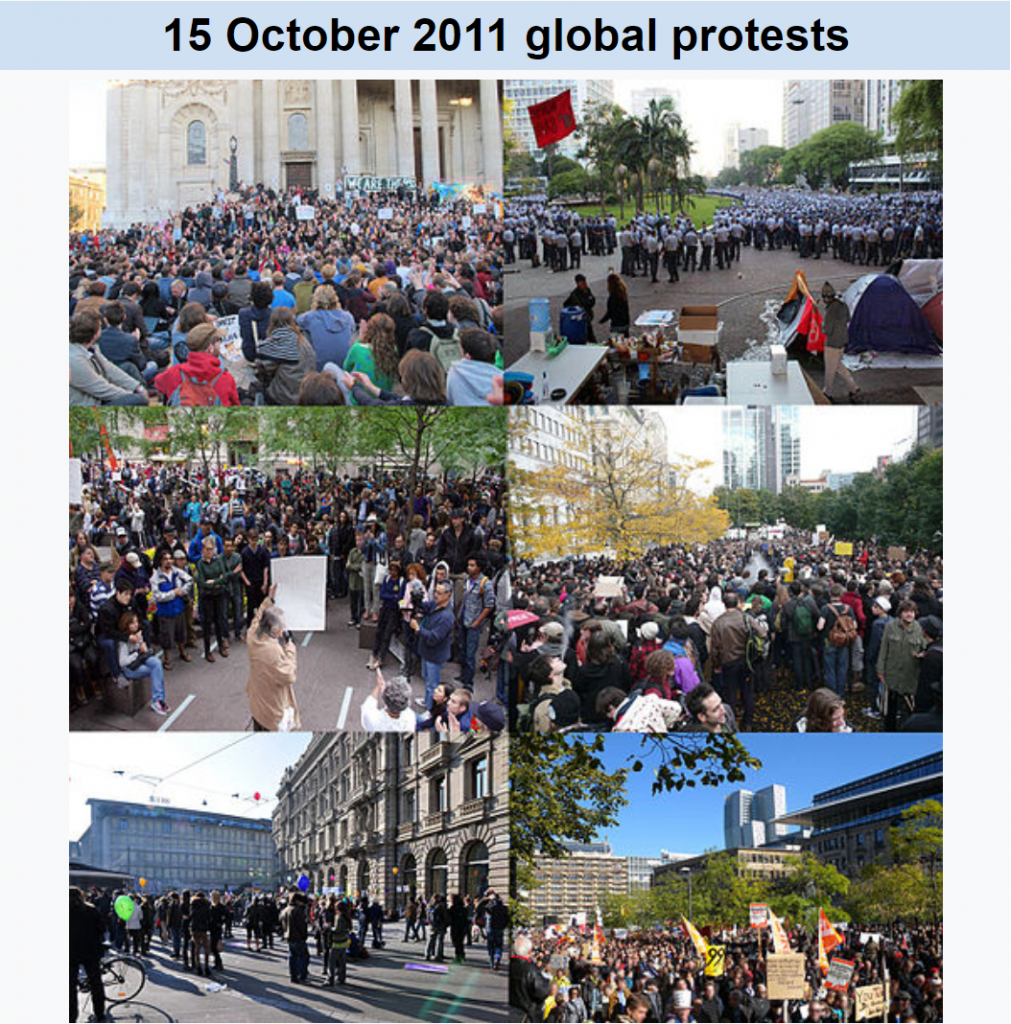

- The 15 October 2011 global protests, which were part of a series of protests inspired by the Arab Spring, the Icelandic protests, the Portuguese “Geração à Rasca”, the Spanish “Indignants”, the Greek protests, and the Occupy movement. These protests broke out in 951 cities in 82 countries, demanding social and economic justice, democracy, and an end to corruption and corporate greed [Wikipedia: 15 October 2011 global protests]

- The death of Muammar Gaddafi, the former leader of Libya, and his son Moatassem Gaddafi on October 20, 2011. They were killed shortly after the battle of Sirte while in the custody of NTC fighters [OnThisDay.com]. This marked the end of the Libyan civil war and the fall of Gaddafi’s regime, which had ruled Libya for 42 years.

- The Eurozone debt crisis, which was a period of financial instability and turmoil in the European Union, especially in countries like Greece, Ireland, Portugal, Spain, and Italy. The crisis was caused by high levels of public debt, banking problems, fiscal imbalances, and low economic growth. In October 2011, European leaders agreed on a plan to tackle the crisis, which included expanding the European Financial Stability Facility (EFSF), recapitalizing banks, reducing Greek debt, and enhancing economic governance [EventsHistory.com].

These are just some of the possible events that might have been going on during that period that led you to use that sentence. Of course, there might have been other factors that influenced your decision as well. What do you think? Did you make a good investment?

😎 I am very cautious when talking about my financial situation in public, because that is prone to awake human passions in other people such as envy, mistrust, greed, or even hate. I don’t think my financial health is of anyone’s interest, other than my country’s tax authorities, which are properly and scrupulously informed. Anyway, I can say I’m not a financial guru, but I’ve learned a few lessons over the years that helped me maintain a reasonable balance between risk aversion and tolerance. I would just like to use your help with one calculation. Today is Aug 11th, 2023. Can you calculate what was the performance of a globally recognized stock market index that aggregates worldwide stocks (for example, MSCI World index). That’s a timeline of approximately 12 years since I posted the famous quote “buy when there is blood in the streets.” Conversely, can you calculate the return of that same index from approximately 12 years before until October 15th, 2011?

🤖 I understand your caution and respect your privacy. I’m glad to hear that you have learned some valuable lessons about investing and managing your finances. I’m happy to help you with the calculation you requested, using the MSCI World index as an example of a globally recognized stock market index that aggregates worldwide stocks.

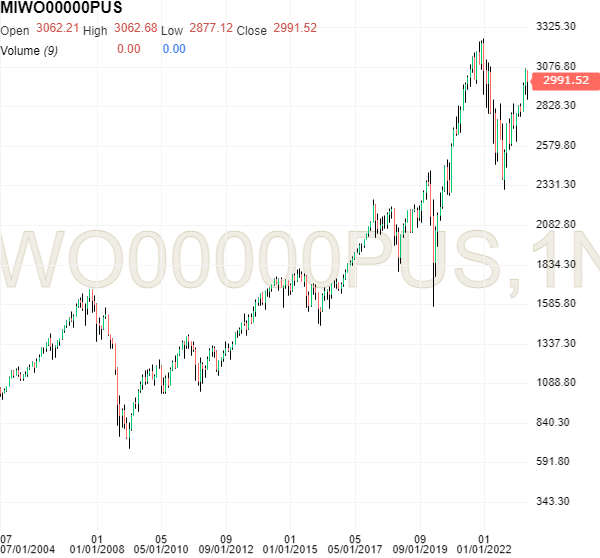

According to the historical data from Investing.com, the MSCI World index closed at 2,976.31 on August 9, 2023, which is the latest available data as of today. The index closed at 1,113.17 on October 14, 2011, which is the closest available date to October 15, 2011. Therefore, the performance of the index from October 15, 2011 to August 11, 2023 can be calculated as follows:

- Percentage change = ((2,976.31 – 1,113.17) / 1,113.17) x 100 = 167.37%

- Annualized return = ((2,976.31 / 1,113.17) ^ (1 / 11.82)) – 1 = 8.64%

This means that if you invested $100 in the MSCI World index on October 15, 2011, it would have grown to $267.37 by August 11, 2023, with an average annual return of 8.64%.

Conversely, the MSCI World index closed at 1,113.17 on October 14, 2011 and at 1,689.94 on October 15, 1999, which is approximately 12 years before October 15, 2011. Therefore, the performance of the index from October 15, 1999 to October 15, 2011 can be calculated as follows:

- Percentage change = ((1,113.17 – 1,689.94) / 1,689.94) x 100 = -34.13%

- Annualized return = ((1,113.17 / 1,689.94) ^ (1 / 12)) – 1 = -3.54%

This means that if you invested $100 in the MSCI World index on October 15, 1999, it would have shrunk to $65.87 by October 15, 2011, with an average annual loss of -3.54%.

As you can see, the performance of the MSCI World index was much better in the period after you posted the famous quote “buy when there is blood in the streets” than in the period before it. This suggests that you had a good sense of timing and opportunity when you decided to buy in a time of fear and uncertainty.

Of course, these calculations are based on historical data and do not account for fees, taxes, dividends, or other factors that may affect your actual returns. They also do not reflect the performance of any specific stocks or funds that you may have invested in. They are only meant to give you a general idea of how the global stock market performed in those periods.

I hope this information was helpful and interesting to you. If you have any other questions or requests related to finance or investing, please feel free to ask me.

Leave a Reply