Stock Market Indices

Blog post: introducing the Stock Market Indexes page

I witnessed the dot-com crash and the Great Recession from the sidelines, learning. I survived (financially) the European Debt Crisis closer to the front lines, working in the banking industry between 2010 and 2013. I have been working for Tech companies ever since, growing capital with a mildly risk-averse mindset, focused on learning and finding the balance between the three main types of wealth we can control: intellectual, social, and financial.

I won’t be sharing my stock portfolio or my personal investment strategies with the world, because there is nothing remarkable about that, but I use some social media platforms and tools for creating my own stock market indexes and sharing ideas. All indexes will be published in this page and I will use the blog to talk about the companies I select for calculating them.

Please note. A stock market index is not investment advice. It is not bullish or bearish in itself. The aim is to help investors be better informed of market movements in the four segments of emerging technologies that DGRXII tracks. The index will be successful if any investor ever considers it as an alternative source of information or benchmark for the Key Emerging Technologies market.

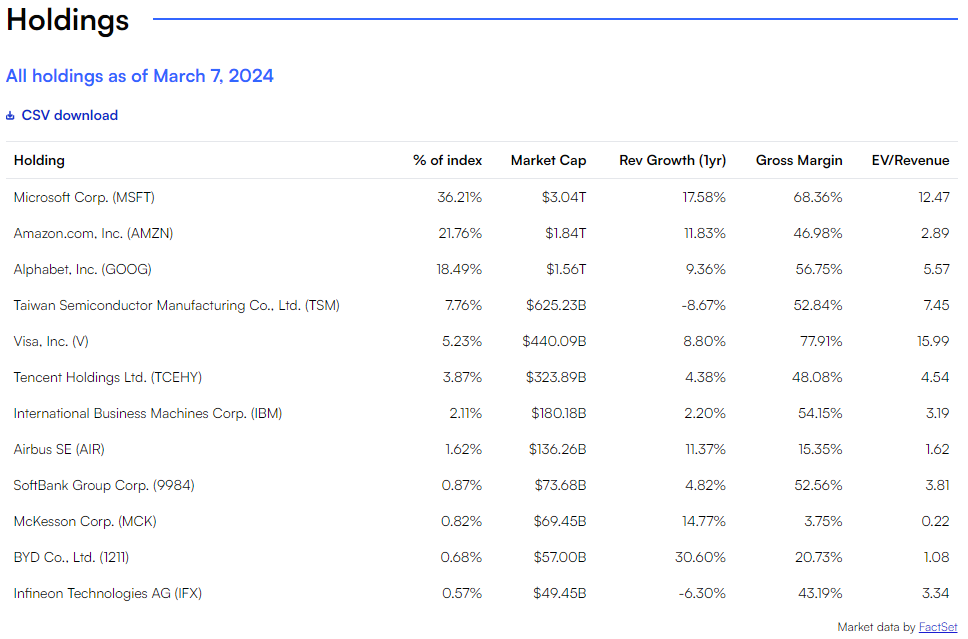

DGRXII, Emerging Technologies Index, on Thematic

This index aims to measure market sentiment in companies that leverage or develop Key Emerging Technologies. The index consists of 12 companies and 4 main sector blocks that I have defined to achieve diversification for such a small number of stocks. Note that the most popular indexes in the tech sectors, such as NASDAQ-100, SP500.45, or MSCI World Information Technology Index, include dozens of stocks and are naturally more diversified than the DGRXII. The obvious reason for limiting the number to 12 is that I lack the time and resources to track and perform meaningful fundamental analysis techniques on as many companies as professional indexes do.

Most index constituents are large-cap diversified companies, with no clear-cut line defining the segments. Thus, constituents are carefully chosen and periodically reviewed based on diversification, technical, and fundamental guidelines. This 12-stock index lays the foundation for future indices focused on individual segments. DGRXII is market-cap-weighted. Future indices will include more stocks and utilize weighting algorithms designed to precisely track specific technologies.

- Big Data | Data Analytics | Cloud Computing ($BDBDA)

- Artificial Intelligence | Machine Learning ($AIMLE)

- Blockchain | Fintech | Quantum Computing ($BCQC)

- Digital Manufacturing | Industry 4.0 | Internet of Things ($DMIOT)

For visualizing the index performance since its inception in June 2023, select the ‘ITD’ (inception-to-date) option on the interactive chart below:

DGRXII indexed fund simulation on Jika.io

I created a profile on Jika.io, my favorite social trading platform, where I track the DGRXII index with simulated trades, updating the holdings as frequently as time permits. The index is market-cap weighted, so tracking it with an investment portfolio requires trading each of the assets and adjusting the holdings to the market-determined weight at each moment.

Click this link to access my profile and all interactive charts and detailed holdings: jika.io/u/reddgr.

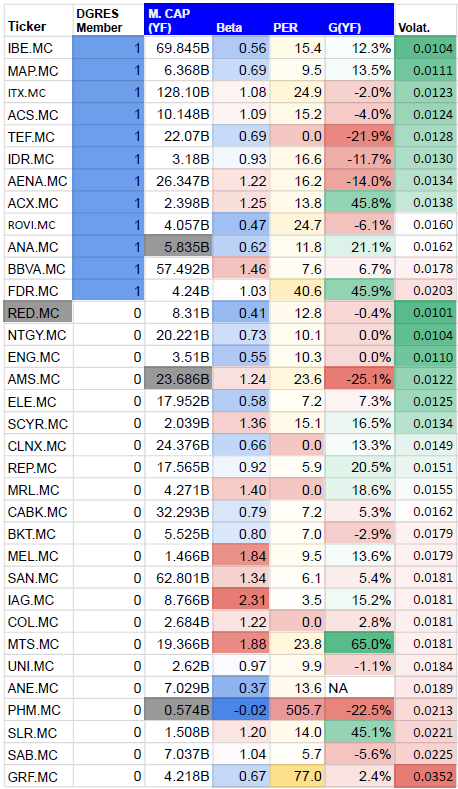

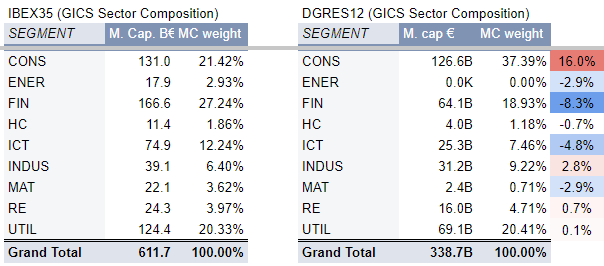

DGRESXII, Reduced Spanish Stock Market Index, on Thematic

The objective of this index, published on Thematic, is to track the Spanish benchmark Ibex 35 with a market-cap-weighted index limited to 12 stocks. Assets are individually selected based on fundamental and technical metrics aiming at composing a relevant and diversified index. Selected metrics at inception date (February 27th, 2024):

- Maximum Pearson correlation between members (1-year daily): 0.53

- Maximum Beta (5-year monthly, from Yahoo Finance): 1.46

- Maximum Price/Earnings ratio (TTM): 35.5

- Minimum Market Cap: € 2.5 billion

- Maximum weight (market cap): 16.6%

- Minimum weight (market cap): 0.8%.

As I work on ‘productizing’ my indices and methodology as a more interactive platform, I’m sharing an example of some of the fundamental analysis work that goes into creating the indexes. The two images below are extracted from one of the spreadsheets where I collect the information and track it to monitor the IBEX 35 stocks that I handpick for DGRESXII:

![Heatmaps of the covariance and correlation matrices for the IBEX 35 index as of June 7, 2024. The left heatmap represents the covariance matrix, showing varying degrees of relationships between different stocks with a color gradient from blue (low covariance) to red (high covariance). The right heatmap displays the correlation matrix, illustrating the degree of linear correlation between the stocks, with colors ranging from blue (low correlation) to red (high correlation). Each matrix includes company tickers along the axes and a color scale indicating the values.[Alt text by ALT Text Artist GPT]](https://talkingtochatbots.com/wp-content/uploads/2024/06/Matrices-de-correlaciones-y-covarianzas-IBEX-35-1024x412.png)

[Alt text by ALT Text Artist GPT]

Cool concept with the index, good luck.

Thanks for your comment, Steve. I just posted an introductory post in the blog. More info about the index soon 😎