Introducing the Stock Market Indexes page

We will soon continue the series of posts inspired by The Playlist, but it’s time to introduce one section of the website you can find under Content -> Stocks. I just added there a short text to introduce the section and explain why I thought it would be a good idea to write content on that topic besides all others that Reddgr will cover. I’m extending the intro in this post. More AI, and stonks, soon:

I witnessed the dot-com crash and the Great Recession from the sidelines, learning. I survived (financially) the European Debt Crisis closer to the front lines, working in the banking industry between 2010 and 2013. I have been working for Tech companies ever since, growing capital with a mildly risk-averse mindset, focused on learning and finding the balance between the three main types of wealth we can control: intellectual, social, and financial.

I’m not a financial advisor or a finfluencer, but I see a gap in the growing community of people who talk about personal wealth management and finances, and I would like to fill it somehow with this website. The gap is the excessive focus that many people have on only financial assets when they talk about wealth and try to understand it. Even within financial wealth management, there is a clear bias among retail investors towards investing only in the stock market, sometimes ignoring the traditional balance of stocks and bonds that professional investors rely on. But that’s too much of a niche topic for this humble blog right now ☺️

Most investors know the basics of stocks and other financial assets, and they have their own ways and plans to profit from them. They might try to buy low and sell high, or seek the best dividend yield, or trade daily, go long or short, or HODL cryptos and stocks until the price goes to the moon 🚀 …. Thanks to the social media revolution that has been going on for the past decade, there is now a thriving community of people who share their knowledge and cooperate on every imaginable hobby or professional activity, including investing and personal finances. You can check out many of my social network profiles, where I share stuff about investing and other things like memes, dog videos, AI images, music, and more, on the Social Links page and other parts of this website.

I would like reddgr/stocks to be just another node (not a Bitcoin node in particular, but all crypto bros are welcome to this site 😎) in the giant network of people who share and talk about their investment strategies and perspectives on personal financial wealth management. I would love to have many more people join, so if you have a related space on social media, or a personal website, please feel free to comment on this blog post, the Stocks page, or connect with me directly and we might find some area of collaboration in the future.

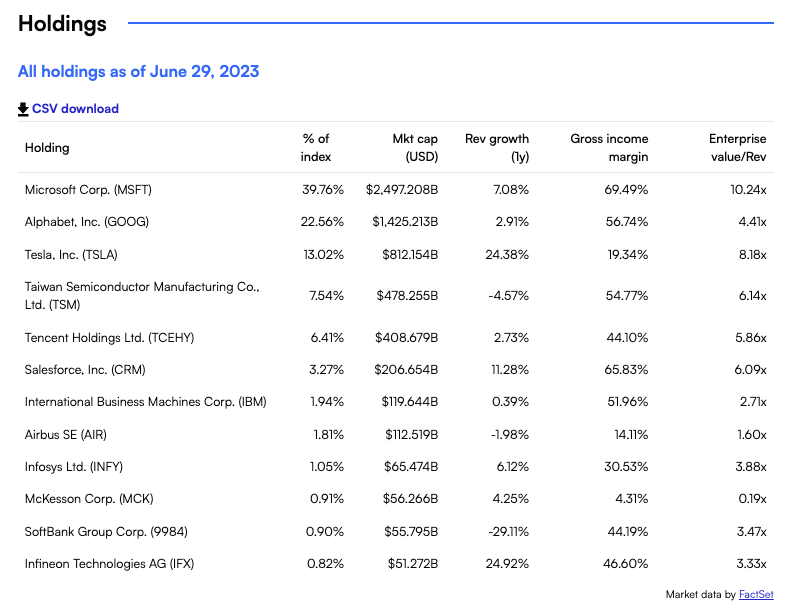

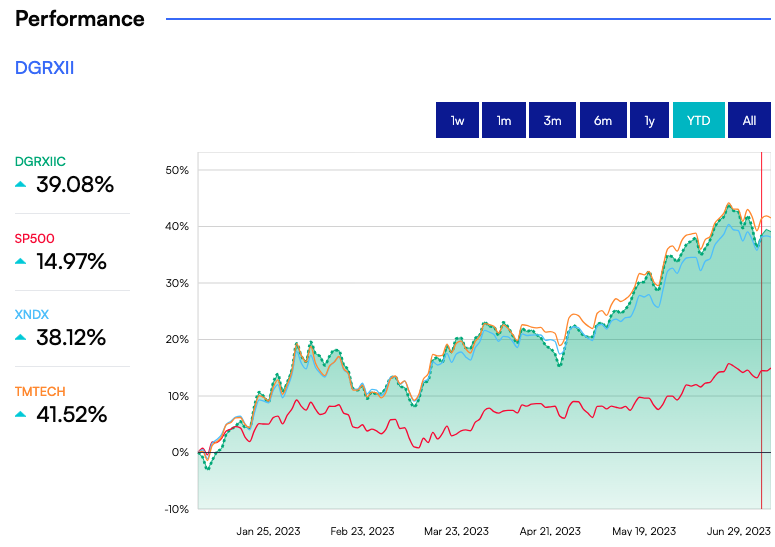

The first initiative I’ve completed on this topic is the $DGRXII index, a tool I’ve built to track a specific part of the market that I’ve named Key Emerging Technologies, including AI, Big Data, IoT, Blockchain, and others. I’m lucky to have some academic and professional experience in most of these fields, so I thought I could add some value to the investment community by pursuing the unusual hobby of building stock market indexes. I have to thank Thematic for making that possible and recommend their platform for anyone sharing this hobby. I’ll soon share more (AI-assisted) information about how I built the index, the companies I selected, and the maintenance I’ll do on the index, its weightings and its constituents. Stay tuned to this blog and the social channels for updates. See below some screen captures from Thematic of how the index composition and trend looks like right now:

But there is more to wealth than just financial wealth, which I believe many people in the investment community, professional or not, tend to ignore or downplay. As we do with stocks, houses, or other tangible assets, we can also “buy” and “sell” the intangibles we own. It’s just a bit harder to conceptualize, but it can work in many different ways, and it’s one of the key elements in my investment and wealth management philosophy.

You can grow (buy) intellectual wealth by trading the time you spend on learning activities, such as going to school, university, reading a book, watching a movie, or reading a blog. As long as you have spare time from other activities, you can decide when to buy this, and when to sell. Time is currency. You sell your intellectual assets when you do any activity that produces a return (financial, social, or intellectual), such as working by performing a job you learned, or building a friendship with a like-minded individual who would choose you as a friend because of your intellectual self, not for your money or your physical attractiveness.

Likewise, you can invest in (buy) social wealth by having dinner with a friend you haven’t seen for a long time, or “sell” it (trading it for financial wealth) when someone who trusts you decides to buy goods at your store instead of going to the competition. Although the returns from trading these assets are only visible in the long term and not as easily quantifiable as buying and selling shares of a company, I believe we should approach wealth from a comprehensive point of view, finding the balance and right timing for all of our trades, not just the financial ones. How we manage it and what we prioritize is up to us, but we should not ignore any type of wealth and take care of all of our intangible assets as well as of our finances.

I’m not trying to be an authority on wealth or give advice on wealth management. I’m just a poor guy who writes an AI-assisted blog about songs and memes, so this first post on the topic is a good opportunity to share a link to one of the thinkers I follow and who inspires some of my personal views, especially on wealth. I don’t agree with everything he says, but I find his thoughts and theories inspiring. If you are reading this, you have probably heard about him, but I’ll provide an alternative introduction with a chatbot conversation. Stay tuned for more AI content on wealth and types of wealth soon 😉.

😎 @naval. Who is behind that Twitter handle?

🤖 @naval is the Twitter handle of Naval Ravikant, the co-founder of AngelList, a platform for startups, angel investors, and job-seekers looking to work at startups [Twitter]. He is also an investor, entrepreneur, thinker, and podcaster. He tweets about topics such as philosophy, technology, business, wealth, happiness, and more. He has over 2 million followers on Twitter and is widely regarded as one of the most influential voices in the tech and startup world [tweet] [tweet].

😎 Can you summarize his point of view on personal wealth management?

🤖 Naval Ravikant has shared his point of view on personal wealth management in various interviews, podcasts, and tweets. He has also co-authored a book called The Almanack of Naval Ravikant: A Guide to Wealth and Happiness [Amazon] [Amazon], which summarizes his principles and advice on this topic. Here is a brief summary of his point of view:

• Wealth is not the same as money. Wealth is having assets that earn while you sleep. Money is how we transfer time and wealth.

• Wealth creation is not a zero-sum game. Everyone can be wealthy if they create value for others.

• You can create wealth by building specific knowledge, accountability, and leverage.

• Specific knowledge is knowledge that you cannot be trained for. It is based on your passions, talents, and skills.

• Accountability is taking responsibility for the outcomes of your actions and decisions. It is how you signal your specific knowledge to others.

• Leverage is using tools, technology, capital, labor, or media to amplify your impact and reach.

• You can choose your leverage based on your judgment, courage, and creativity.

• You can increase your leverage by building a brand, a reputation, an audience, or a network.

• You can also increase your leverage by owning equity in a business or an asset that generates cash flow.

• You can achieve financial freedom by saving and investing your money wisely. You should invest in things that you understand and that have asymmetric upside potential.

• You should avoid debt, fees, taxes, inflation, and bad habits that erode your wealth.

• You should also avoid envy, resentment, and comparison that make you unhappy with your wealth.

• Happiness is a state of mind that you can cultivate by practicing gratitude, mindfulness, and detachment.

• Happiness is not dependent on external factors such as money, fame, or status. It is a function of your expectations and reality.

• Happiness is also a function of your relationships and interactions with others. You should surround yourself with positive, honest, and rational people who support your growth.

[Amazon]

The Almanack of Naval Ravikant: A Guide to Wealth and Happiness

😎 How can wealth be classified?

🤖 Wealth can be classified in different ways, depending on the perspective and criteria used. One possible way to classify wealth is based on the following four types:

• Financial wealth: This is the most common and obvious type of wealth, which measures how much money or assets someone has accumulated. Financial wealth can be expressed in terms of net worth, income, investments, savings, or assets [Investopedia] [InspireToFIRE].

• Social wealth: This is the type of wealth that comes from having meaningful and supportive relationships with others, such as family, friends, community, or network. Social wealth can be expressed in terms of social capital, trust, influence, reputation, or belonging [InspireToFIRE] [Simplicable.com].

• Time wealth: This is the type of wealth that comes from having control over one’s time and freedom to pursue one’s passions and interests. Time wealth can be expressed in terms of flexibility, autonomy, leisure, or work-life balance [InspireToFIRE] [Simplicable.com].

• Health wealth: This is the type of wealth that comes from having a good physical and mental well-being. Health wealth can be expressed in terms of vitality, longevity, happiness, or quality of life [InspireToFIRE] [Simplicable.com].

These four types of wealth are not mutually exclusive and can influence each other. For example, having more financial wealth can enable more time and health wealth, but having less social wealth can reduce health and happiness. Therefore, it is important to balance and optimize these types of wealth according to one’s values and goals.

😎 That’s a valid classification, but not the one I like most. I don’t consider time a type of wealth, but a parameter we can’t control and inextricably devalues. Instead, I believe it’s fundamental to leverage and increase intellectual wealth in combination with other types of wealth. Is there a wealth classification framework that includes intellectual wealth?

🤖 I understand your preference for intellectual wealth, which is the type of wealth that comes from having valuable knowledge, skills, or information that can create value for oneself or others. Intellectual wealth can be considered a subset of intangible assets or intellectual capital, which are the non-physical resources of a company or an individual that can generate economic benefits [World Intellectual Property Organization] [Investopedia].

One possible framework that includes intellectual wealth is the Intellectual Capital Framework, which divides intellectual capital into three components: human capital, structural capital, and relational capital [World Intellectual Property Organization] [Investopedia] [Emerald Insight].

• Human capital: This is the type of intellectual wealth that resides in the minds and abilities of the employees, such as their knowledge, skills, creativity, innovation, motivation, and loyalty.

• Structural capital: This is the type of intellectual wealth that is embedded in the organizational processes, systems, culture, and policies that support the performance and efficiency of the employees.

• Relational capital: This is the type of intellectual wealth that is derived from the relationships and networks that the company or the individual has with external stakeholders, such as customers, suppliers, partners, investors, regulators, and society.

[World Intellectual Property Organization] [Investopedia] [Emerald Insight]

This framework can help measure and manage the intellectual wealth of a company or an individual by identifying the sources, outcomes, and drivers of intellectual capital. It can also help align the intellectual wealth with the strategic goals and sustainable development of the company or the individual.

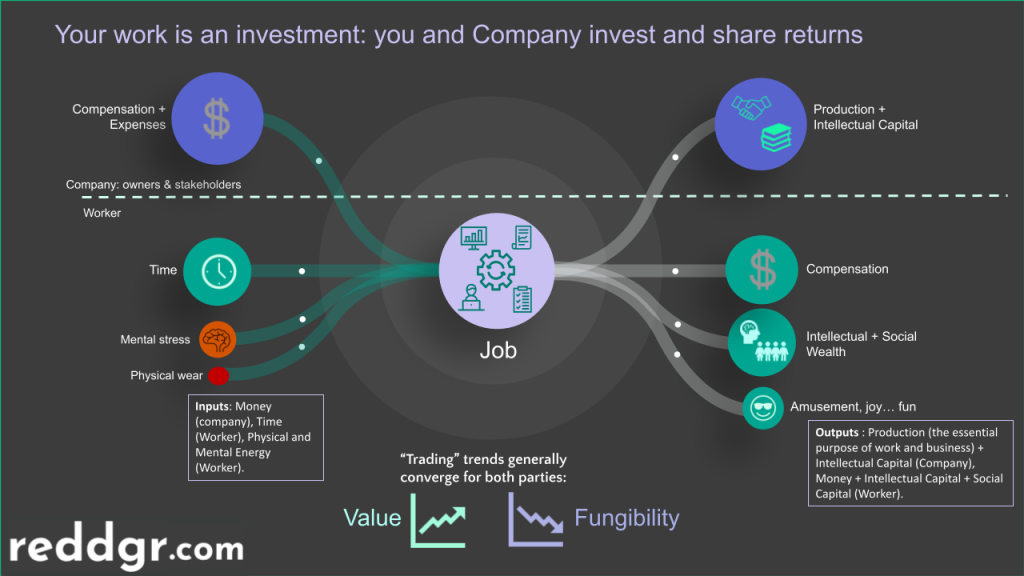

😎 Thank you, I like how this framework equates the types of assets a company owns and the types an individual owns. This aligns with the theory I explained when training coworkers at my employer: work is an activity that requires leverage from both the company and the individual worker, and creates wealth for both.

For a business to be successful, wealth creation needs to converge for both parties. What do you think of this theory?

🤖 That’s an interesting theory. I think it makes sense that work is an activity that requires leverage from both the company and the individual worker, and generates wealth for both. Leverage is the use of tools, technology, capital, labor, or media to amplify one’s impact and reach. Both the company and the individual worker can benefit from using leverage to create more value for themselves and others. For example, a company can use technology to automate its processes and increase its productivity, while an individual worker can use skills to solve problems and increase their income.

However, I also think that wealth creation may not always converge for both parties. Sometimes, there may be a trade-off or a conflict between the interests of the company and the individual worker. For example, a company may want to reduce its costs by outsourcing its labor, while an individual worker may want to increase their wages by demanding better working conditions. In such cases, wealth creation may diverge for both parties.

Therefore, I think that for a business to be successful, wealth creation needs to balance for both parties. There should be a fair and mutually beneficial exchange of value between the company and the individual worker. Both parties should respect each other’s rights, needs, and goals, and seek to create win-win situations. This way, wealth creation can converge for both parties in the long run.

😎 That’s a good way of explaining it. The best term to describe success in this case is probably not convergence, but balance. But I still think if wealth creation does not sustainedly converge for both business and worker, the business is fated to lose competitiveness and fail

🤖 I see your point. I agree that if wealth creation does not sustainedly converge for both business and worker, the business may lose competitiveness and fail. This is because the business may lose its human capital, which is the most valuable type of intellectual wealth. Human capital is the knowledge, skills, creativity, innovation, motivation, and loyalty of the employees. Without human capital, the business may not be able to innovate, adapt, or grow in a changing market. Therefore, the business should strive to create wealth that converges for both itself and its workers, by providing them with fair compensation, recognition, development, and empowerment. This way, the business can retain and attract talented workers who can contribute to its success.

😎 ❤️

In it something is. Thanks for the help in this question. All ingenious is simple.