What Are the Main Asset Classes One Can Invest in?

🏦 Themes: Finance and Wealth, Blockchain

🤖 Chatbots: ChatGPT

⚙️ Prompt engineering: Web Research, Controversial Questions

😎 Review my response to the question and let me know if I’m missing any asset classes:

Question – What are the main asset classes one can invest in?

Answer – Assuming investing refers only to investing your cash (how you manage your time is also an important form of investment):

- Personal Property

- Real Estate

- Publicly traded equity

- Private equity (this is not easily accessible for most people)

- Bonds (public and corporate)

- Bank deposits

- Financial Derivatives (CFD’s, options, swaps…)

- Foreign Currency

- Commodities (most of these typically not easily accessible for most people)

Additionally, you can also invest in investment funds which may reinvest in any or a combination of the previous asset classes, so they are not an asset class by themselves.

🤖 […full chat…] Here’s a revised version:

Asset classes one can invest in typically include:

- Personal Property

- Real Estate

- Equities (Publicly traded and Private equity, although the latter may not be easily accessible for most investors)

- Bonds (Both public and corporate)

- Bank Deposits

- Financial Derivatives (CFDs, options, swaps, etc.)

- Foreign Currency

- Commodities (Although many are not easily accessible for most investors)

Additionally, investment funds, such as mutual funds, REITs, and ETFs, allow you to invest in a diversified portfolio across various asset classes. Keep in mind that the accessibility of certain asset classes may vary depending on your financial situation and expertise.

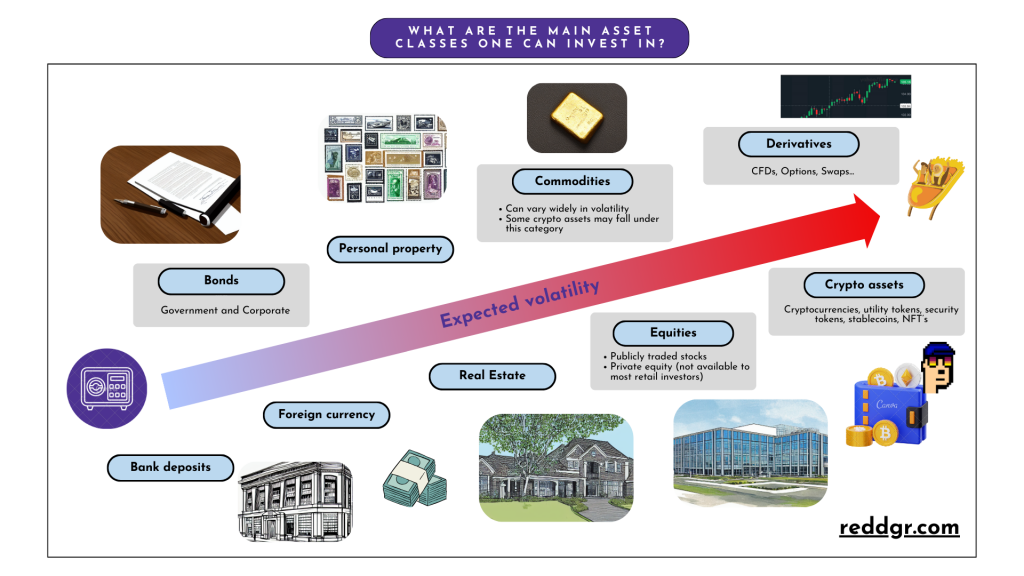

😎 Can you sort the asset classes by expected volatility? Write the same response and list, but reorder the asset classes based on general volatility. There is probably not a straightforward order, but some classes are clearly more volatile than others (for example, real estate valuations are typically less volatile than equities)

🤖 Certainly, I can provide a general ordering of asset classes based on expected volatility:

- Bank Deposits (Lowest expected volatility)

- Bonds (Both public and corporate)

- Foreign Currency

- Personal Property

- Real Estate

- Commodities (Can vary widely in volatility)

- Equities (Publicly traded and Private equity, with publicly traded often being more volatile)

- Financial Derivatives (CFDs, options, swaps, etc.) (Potentially high volatility)

Additionally, investment funds, such as mutual funds, REITs, and ETFs, allow you to invest in a diversified portfolio across various asset classes, which can help manage overall portfolio volatility. Keep in mind that this ranking is a general guideline and that specific investments within each asset class can have varying levels of volatility. Volatility can also change over time due to market conditions.

😎 Can you rewrite the list including cryptoassets? Mention that some crypto assets may be classified as commodities or securities, but they might be considered an asset class of their own.

🤖 Here’s a revised list that includes crypto assets and clarifies their unique status:

- Bank Deposits (Lowest expected volatility)

- Bonds (Both public and corporate)

- Foreign Currency

- Personal Property

- Real Estate

- Commodities (Can vary widely in volatility; some crypto assets may fall under this category)

- Equities (Publicly traded and Private equity, with publicly traded often being more volatile)

- Financial Derivatives (CFDs, options, swaps, etc.) (Potentially high volatility)

- Crypto Assets (Cryptocurrencies, which may be considered an asset class of their own, although some crypto assets may be classified as commodities or securities)

It’s important to note that the classification of crypto assets is evolving, and regulatory authorities in different countries may categorize them differently. Some cryptocurrencies, like Bitcoin and Ethereum, are often considered a separate asset class due to their unique characteristics and use cases, while others may be treated as commodities or securities based on their features and how they are used.

✍️ Note: a follow-up question about how to classify crypto assets was posed to ChatGPT and several other chatbots. Due to the complexity of the topic, those questions can be found in a separate Talking to Chatbots page.

🖼️ The infographic used as featured image was created with Canva [Canva template].

Leave a Reply